Over View of 2020 Total Tax Contribution Report on Ghana’s Telecommunications Industry

Introduction

The Ghana Chamber of Telecommunications (GCT), is an industry association, representing the interests of telecommunication operators and infrastructure companies namely; AirtelTigo, MTN, Vodafone, American Tower Company, Helios Towers, Huawei, Comsys and C-Squared. Our members offer services ranging from fixed and mobile telecommunications to mobile data solutions, Internet services and mobile financial services.

Purpose of Study

Our study objective was to measure the size of the contribution that members of GCT have made to the government of Ghana during the 2020 fiscal year. All GCT members took part in the study by providing data relating to their tax and other statutory payments for the financial/tax year ending 31 December 2020.

Methodology

The Total Tax Contribution (TTC) methodology was employed to carry out the study. This methodology measures the total cash tax payments made by each of our members through its business operations. The TTC study considers not only corporate income tax but also all taxes borne and collected by the members of the Chamber as well as other statutory payments made to government agencies and regulators.

Taxes borne are those taxes, which are a cost to the company when paid, and they in effect affect the results of the company, such as corporate income tax and employers’ social security contributions.

Taxes collected are those taxes that are collected and administered on behalf of the government, such as withholding taxes and employees’ social security contributions. Although these tax contributions are not a cost to the company collecting them, we argue firmly that it is through our activities as collectors of government taxes that lead to the realization of these taxes and this have cash flow implications for our members in effect and also impact either directly or indirectly on the prices charged by our members. It is important to note that the over ¢31 million collected as withholding taxes from the about 328,000 registered merchants and agents would have been almost impossible to have collected.

The collection of the taxes has an indirect cost to our members as it makes the product and service relatively more expensive but that is not factored in this study. Additionally, there is a cost to collecting the tax as an agent of the government that has also not been accounted for in this study.

Our methodology covers largely taxes paid to the central government as well as other remittances relating to fees, charges, levies and permits paid to key government agencies such as assemblies and other key ministries and regulators within the country.

To influence government policy and regulatory interventions on the sector, the Chamber believes there is the need for adequate information on industry’s costs, tax contribution and compliance, and its overall enabling impact on the economy.

This should improve investor relations and appetite for investments in the Ghanaian market (industry) so that ultimately, the promise of digital inclusion, connected society and the Government’s digital agenda can be attained within the short to medium term.

Findings

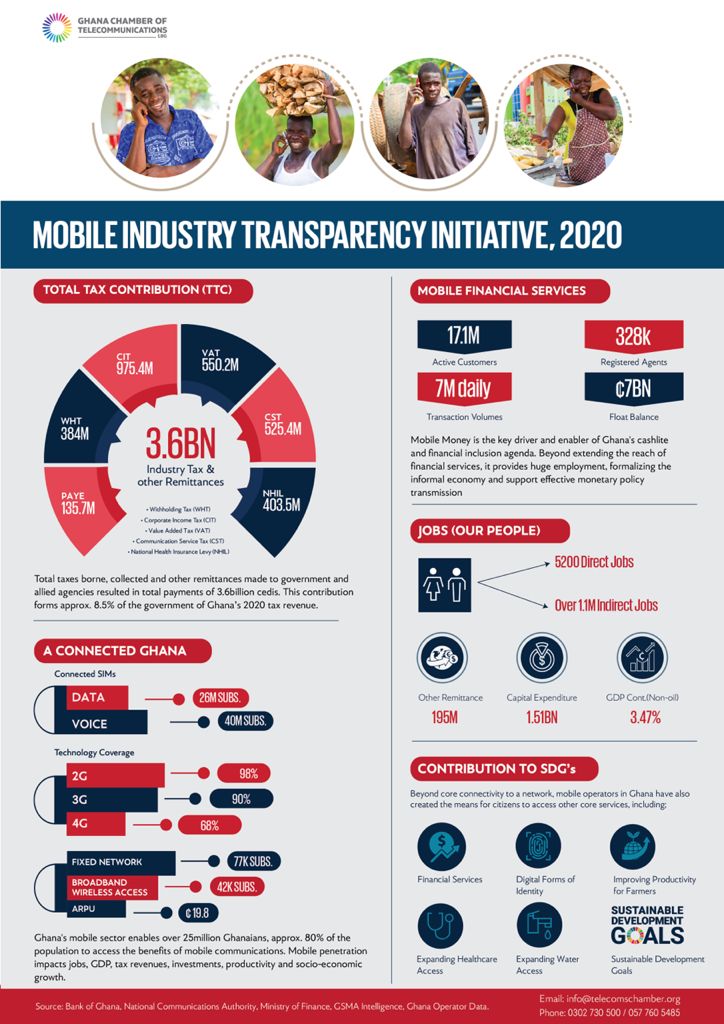

Based on the results of this study, the eight participating companies in 2020 made a total tax contribution of over ¢3.6 billion in the 2020 calendar year. This represents total taxes borne, collected and other payments and remittances made to the central government and other allied agencies.

Top Tax Lines

Corporate Income Tax (CIT) constituted the largest tax type paid from the study. This tax relates to taxes borne by the members of the Chamber. The general corporate income tax rate is 25% and the industry contributed in monetary terms, ¢976 million which represents approximately 26.8% of the TTC

Value Added Tax VAT stood as second of the top tax lines of the industry, representing approx. 15.1% of the TTC in money terms of over ¢550 million. This tax line, although is a pass-through cost, which can be passed on to final consumers, puts an administrative obligation on the Chamber members to correctly administer, collect and pay them over to the government. In addition to this, members of the GCT were also sometimes the final consumer from input VAT incurred on expenses made within the business.

Communications Service Tax (CST) also stood as another of the top tax lines in the study, representing also 14.5% of the TTC, in monetary terms of over ¢525 million. This is an industry-specific tax and was introduced in 2008 to raise additional revenue from communications services rendered by telecom operators to their customers. In 2013, the law was amended to further expand the scope of services subject to CST to include interconnect services and in 2020 the talk tax rate was reduced to 5%.

Other product taxes, regulatory fees and the Universal Service Fund (USF), which mainly consist of the 1% annual net revenue, required to be paid to the National Communications Authority (NCA) on a quarterly basis and an additional 1% of total revenue required to be paid into an electronic fund set up by the government (GIFEC) was approx. 3.8% of the TTC representing ¢138 million. These statutory payments are based on the top line of the businesses and are payable whether a business makes a profit or not.

Mobile financial services (MFS) for the first time contributed a whopping 5.91% tax contribution to the TTC which in monetary terms is about ¢215 million and largely attributed to Corporation Taxes and withholding taxes (WHT) paid from commissions to merchants and other engagements with suppliers, management services etc.

Employment is generated through a wide range of direct and indirect activities in the sector. The members of the Chamber are known to be age-old large employers and in 2020 they employed a direct and indirect workforce of 5,700 and 1.1million personnel respectively. This accounted for the collection of Pay as You Earn (PAYE) on their behalf resulting in the government receiving approx. ¢136 million which is 3.7% tax contribution to the entire study and 1.81% of National total personal income taxes realized within the year 2020.

The 2020 TTC of the mobile industry forms approximately 8.5% of the government of Ghana’s tax revenue (Ministry of Finance, 2020 budget statement) for 2020. This contribution, analysts argue rather conservative and does not take into consideration the inputs of other industry players in the study, nevertheless demonstrates the importance of the mobile industry to the government’s tax revenue and national GDP and economic growth.

Trends of our TTC study over the last three years has shown continuous average annual growth of over 28%. From GHS1.74bn in 2017, GHS2.2bn in 2018, and GHC3.2bn in 2019. There has however been a continuous decrease observed on certain lines such as import duties, SIIT which creates a need for further analysis.

We can attest to the importance of the mobile sector and its contribution to Ghana’s economic and fiscal stability, both through its own contribution to the economy and government revenues, as well as the contribution of the associated ecosystem of industries. The sector continues to support and catalyze other sectors such as banking, media, advertising, agriculture, health, education, creative arts as well as facilitating social and familial communication and stability.

In anonymizing and aggregating the study data, the issue of profitability is non-active across a greater majority of service providers used in the study, although ironically, CIT stood out as the biggest tax contributor in the study. Other remittances relating to fees, levies, charges made to multiple agencies working directly with the industry came to a total of ¢195 million.

From the analysis, it can be concluded that for every ¢100 that is paid to the operators within the industry, they pay back ¢48 in the form of direct and indirect taxes, as well as other remittances to the government as explained above. The remaining ¢52 goes into investment in the people, the business (CAPEX), the supply chain (procurement), marketing, general operations and its very unlikely that any of these funds are left to be paid back as dividends to shareholders which is the real objective of business everywhere in the world. What is important to also note is that the less availability of funds means future investments are likely to suffer and this hurts the quality of the network and service delivery.

The Covid-19 pandemic has affected FDI inflows and investible funds required by service providers to boost capacity with the growing demand for voice and data services. This is coupled with a huge acceleration in the growth in data demand faster than new capacity being installed in networks resulting in a data capacity deficit

The industry thrives on huge annual capital expenditure, to keep supporting the exponential growth in the network, product and services. Over the two years, 2020 and 2021, the Industry will invest over ¢3 Billion in network and IS infrastructure expansion. This will increase data capacity by 130% from 2.2Million TB/day to 3.6Millio TB/day from March 2020 to March 2021. The traffic is expected to grow to 5 million TB/day in December.

However, we believe there is still a lot more that can be done together, between operators and the regulator to resolve the data capacity challenge. This would include some policy and regulatory interventions There is an urgent need to rebalance taxes in the sector to promote digital inclusion, economic growth and fiscal stability because almost every other sector is dependent on our sector now.

One of the studies we would want to carry out before the end of this year is a comparative study of the fees and permits charged the telecommunication industry in Ghana compared with that of other African countries to benchmark and also advise on policy to be able to advance digital transformation drive as a country. A cursory look at the data shows that we are more expensive compared to Uganda, Kenya, Nigeria, Burkina Faso and Niger. While most of them have a maximum of 3 regulators and agencies they have to take permits from before the installation of towers. We have 5 agencies we have to deal with, with a very long lead time. We are encouraged that the Ministry of Communications and Digitalization is considering the reviewed telecommunication tower installation guidelines for approval. This should pave the way for a one-stop-shop for permitting and approval for tower installation.

We ask for more government partnerships to deliver our services to customers as well as meet government expectations of the industry because in these partnerships we will find solutions to the greater challenges that affect the industry.

In conclusion, Mobile is the most cost-effective way of extending access to ICT, the internet in Ghana as well as driving the digitization agenda we pursue. It is therefore fundamental to helping our government achieve its objectives of expanding ICT infrastructure, meeting last-mile goals, connecting the unconnected and positioning our economy as a smart and digital-ready market towards further growth.

Thank you all.

God Bless Our Homeland Ghana

This post has already been read 903 times!

Post Comment