Uganda approves mobile money bond scheme

Uganda’s government approved proposals to sell national bonds through the country’s mobile money platforms, a policy politicians believe will increase financial inclusion and widen the country’s range of investors.

In an explanation of the scheme on social media, an Ugandan cabinet representative said it would “enhance distribution capacity” of government securities to individual investors, especially those in rural areas.

It also reduces the concentration of bonds held by international institutional investors. The value of investments set to be offered was not disclosed, nor was notification of which of the country’s mobile money platforms would participate.

The announcement follows a fractious period between the country’s authorities and mobile money providers sparked by the introduction of a controversial tax on transactions at the start of July 2018.

In the first fortnight after the taxes were imposed, the value of funds processed on platforms reportedly sank by UGX672 billion ($182 million).

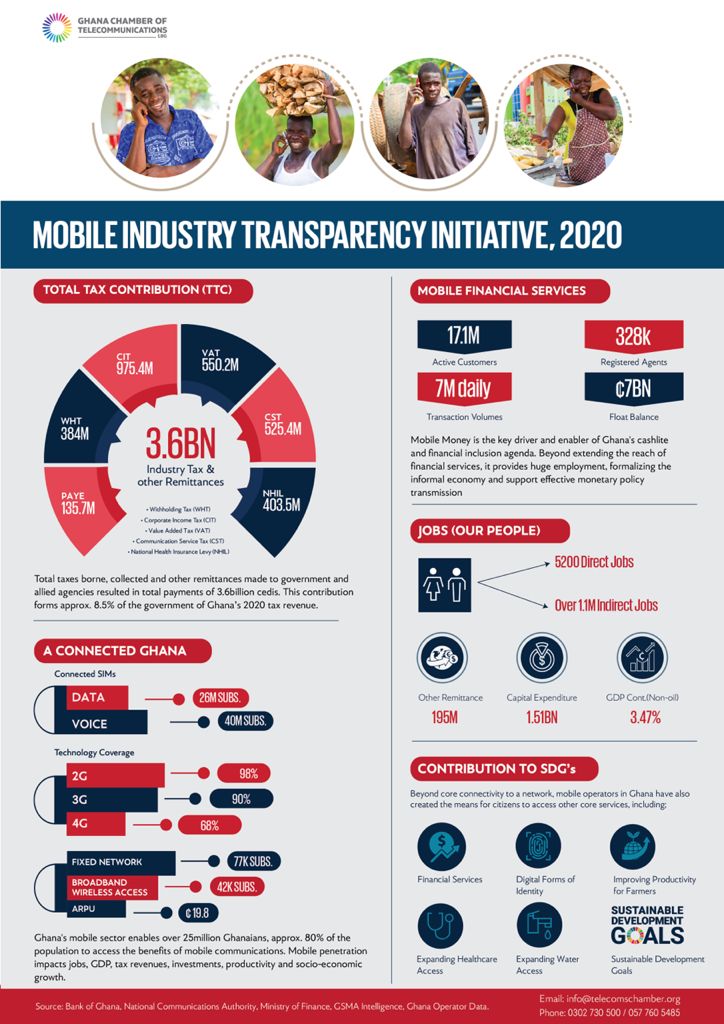

Uganda’s move to sell bonds is similar to an initiative in neighbouring Kenya, where the government offered a batch of investments through Safaricom’s m-Pesa and Airtel Money platforms in 2017 Then there is also the Ghana example where MTN executed its IPO through Mobile Money.

This post has already been read 375 times!

Post Comment